Financial Institutions

Customer needs are changing

To stay relevant, you need to create experiences that not only engage them, but transform their lives. Experiences they cannot live without.

We’ve been helping businesses like yours innovate for more than 30 years. With our customer-centric approach to digital transformation, we’ll break down siloes, connect you with the right partners, and create everything you need to transform your business — from idea to build. So you can deliver the experiences your customers deserve.

Relax. Your banking transformation is in safe hands.

Technology is reshaping the banking industry. And banks are facing a stark choice: lead the way by offering personalized, customer-focused products and services, or get left behind.

With our unique SPEED approach to digital banking transformation, we’re helping banks meet the challenges of tomorrow at speed. From idea to build, we’re creating new customer-centric products and services, and delivering business-wide change for our clients.

How we can help

Whatever your digital goals, our expert teams in strategy, product, experience, engineering and data will help you achieve them.

Engage your customers

Attract new customers — excite existing ones. Create loyalty and drive business growth by understanding your customers and giving them what they want.

Transform your experience

Tailor your experiences to the needs of today’s customers and create omnichannel experiences they’ll love.

Modernize your core

Legacy architectures stifle innovation and are more costly to maintain. Modernize your core and accelerate your transformation.

Update your tech

Unlock your data and increase resilience with technology that scales alongside your business.

Harness the cloud

Want to boost efficiency while simultaneously transforming your business? Harness the cloud for an innovative, agile future in banking.

Innovate, fast

Build a new bank in as little as six months. And create new banking products 5x faster with our unique methodology.

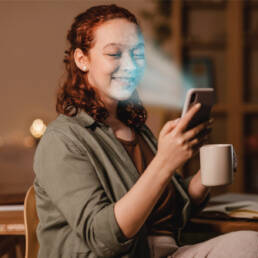

Personalized Experience

Business Intelligence in Financial Services -Transforming Data insights into tangible value for actionable insights to offer cutting-edge customer insights.

Achieve Customer Journey Transformation using our Hyper-Personalization digital platforms to achieve Breakthrough Customer Service.

Unleash your bank data potential -As banks grow their data systems often struggle to cope with influx of customer demands

Modernization of banking processes to fully optimize service delivery.

Speed Layer

Unlock your data and grow your business with our resilient and scalable data platform

Financial services firms are facing unprecedented challenges. Customers expect 24/7 access to services and products and expect their banks and insurance companies to deliver fast and seamless customer experiences.

But businesses are often locked into legacy technologies or mainframe systems—halting innovation, limiting real-time processing of data and failing to deliver an optimal experience for their users. The result: slower growth, lost cross-sell and up-sell opportunities and dissatisfied customers.

Modernizing legacy technologies without crashing the core systems can seem like a daunting task, but it’s essential if you want to remain competitive with digital challengers, enable real-time access to data and provide better customer experiences.

Introducing Neuron Platform

That’s why we built the Neuron Platform: a data confluence platform designed to unlock your data, boost your resilience and grow your business.

Neuron solves the problem of data demand, enabling banks to create resilient and real-time engagement experiences, reduce costs and enable future innovation at speed.

Hyper-Personalized Services

Understand your customers, tailor your engagement and transform your business with our Hyper Personalization Digital Platform solution.

Two-thirds of customers today expect their banks to know their needs, deliver personalized engagement and tailor offers exclusively for them. But many financial institutions continue to drive a non-personalized approach to customer acquisition, with irrelevant offers and one-size-fits-all comms. The result? Low conversion rates and dissatisfied customers.

Five years ago, that would have been shortsighted. But today, with new digital-savvy fintechs driving growth in consumer loans, lenders without a customer-centric engagement strategy are facing a big problem.

Our solution is based on four key principles

Intent

Assessing your customers' wants and needs and identifying the audience with the highest intent.

Top of mind

Using online and offline triggers, reaching your target audience when lending is top of their mind.

Personalization

Delivering personalized engagement that resonates with their wants and needs.

Always on

Listening to emerging signals and being first with personalized engagement.

A 360-degree view of your customer

It all starts with the customer.

Through Nanogon Digital we can collapse vast amounts of customer data from varying demographics and dissimilar silos. We enrich this with our sophisticated machine leaning and Artificial Intelligence models to create compelling and highly personalized of each experiences.

We’ll create and test these value propositions and manage the activation and channel optimization to ensure the right messaging reaches the right customers in the right places. We’ll also create individual path-to-purchase journeys to engage, nurture, retarget and convert each customer, wherever they are in their journey.

Test,

Optimize,

and Scale.

With your value propositions and activation strategies defined, we’ll run a pilot test to optimize your strategy. Using multiple data points, we’ll assess the effectiveness of the customer engagement messaging, refine the intent model based on the customer response and optimize your acquisition strategy against your business objectives.

Improving customer acquisition with hyper-personalized user experiences.

Personalization is a huge buzzword in the financial services industry right now. Organizations that continue to drive a non-personalized approach to customer acquisition are losing customers, market share and revenue.

The solution? To create hyper-personalized user experiences that deliver increases in topline revenue, profit margin and growth. But marketing teams that are looking to increase personalization and boost conversion rates while lowering acquisition costs need to maximize the utilization—and understanding—of their data.

Find out how it works

Book a meeting today and we’ll show you how you can make the most of your data. We can also use federated machine learning to securely evaluate your organization’s data, identify the best approach for monetization and improve your data science and AI capabilities.

Our step-by-step solution

At Nanogon, we’ve developed data science capabilities to build greater customer understanding and hyper-personalized user experiences. Through our step-by-step process we’ll build these new capabilities into your existing marketing stack to ensure you’re delivering the highest ROI and value for your organization.

1. Business understanding

We begin by evaluating your customer understanding, the state of your analytics, your ad targeting and how they align with your broader business goals. We’ll also evaluate your business strategy and assess your current goals and KPIs.

2. Data understanding

Next we assess the availability and utilization of your data. We work out where you’re capturing data and where you have untapped data sources. We’ll also lift the lid on your tech to see what it’s capable of and where it might need upgrading.

3. Data preparation

Now we have your data, we prepare it to enable data mining and feature engineering. We do this by merging your data into a central repository (BigQuery) and applying advanced statistical analysis and visualization techniques to maximize utilization and monetization of the data.

4. Modeling

Now we can begin modeling. We experiment rapidly through an advanced, highly automated MLOps environment to build, train and test many models at speed. enabling rapid experimentation of model architectures and data features.

5. Evaluation

With deep understanding of your business goals, we identify the model or ensembled models that provide the greatest business value. We evaluate how often the model should be monitored and updated to provide frequent incremental improvements in performance, account for bias and explainability in our evaluations and identify retraining frequencies that account for model drift.

6. Deployment

We utilize the latest software engineering technologies that best fit your business to deploy models that support resilient operations at scale. Your business grows and profits increase as you attract new customers.

7. Knowledge application

Our data strategy team advise you on ongoing business and workflow transformation and identify areas in your business and workflows capabilities that can be further integrated to boost ROI and business value.

Every year banks are investing more and more time and money into maintaining their legacy core. And new regulations, rising customer expectations and open banking are stretching these systems to the limit.

But upgrading isn’t easy; it’s complex, costly and risky. And most transformation programs fail.